Loading

Get G26.pdf. Use Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G26.PDF Use Tax Return online

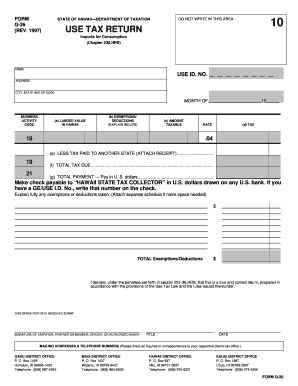

The G26.PDF Use Tax Return is an essential document for reporting the use tax owed on imported goods in Hawaii. This guide will walk you through the process of completing this form online, ensuring you understand each section and field to facilitate accurate filing.

Follow the steps to successfully complete the G26.PDF Use Tax Return.

- Click the ‘Get Form’ button to download the G26.PDF form and open it in your preferred PDF editor.

- Begin by entering your name in the NAME field at the top of the form. Next, fill in your USE ID number, which identifies your tax account.

- Provide your ADDRESS, CITY, STATE, and ZIP CODE to ensure the tax office can contact you if necessary.

- Indicate the MONTH of the tax return you are filing. This is crucial for filing the correct period's taxes.

- Specify your BUSINESS ACTIVITY CODE. This code indicates what type of business activity the goods are related to.

- In section (a), enter the LANDED VALUE IN HAWAII of the goods you are reporting. This value should encompass the total cost of the items once they have landed in Hawaii.

- For section (b), detail any EXEMPTIONS or DEDUCTIONS you are claiming. Use the space provided to explain each deduction taken.

- In section (c), calculate and record the AMOUNT TAXABLE, which is the LANDED VALUE minus any EXEMPTIONS or DEDUCTIONS.

- Next, under section (d), calculate and input the TAX owed based on the applicable rate of 0.04 as indicated in the form.

- If applicable, in section (e), provide any LESS TAX PAID TO ANOTHER STATE, attaching the receipt as proof.

- In section (f), calculate the TOTAL TAX DUE by adding the TAX amount and subtracting any tax paid to another state.

- Finally, in section (g), list the TOTAL PAYMENT amount due. Payments should be made in U.S. dollars, and checks should be payable to ‘HAWAII STATE TAX COLLECTOR.’

- Sign and date the form in the designated areas to affirm that the information provided is accurate and true.

- Once completed, save your changes, download the form for your records, and print it if necessary.

Complete and submit your G26.PDF Use Tax Return online today to stay compliant with Hawaii's tax regulations.

Hawaii general excise tax returns are always due the 20th of the month following the reporting period. If the filing due date falls on a weekend or holiday, general excise tax is generally due the next business day.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.