Loading

Get G 17 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G 17 Form online

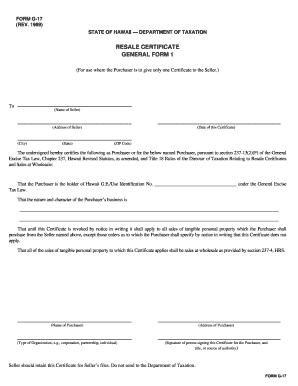

The G 17 Form is a resale certificate used in the State of Hawaii for general excise tax purposes. This guide will walk you through each section of the form to ensure accurate completion and submission.

Follow the steps to fill out the G 17 Form online effectively.

- Click the ‘Get Form’ button to access the G 17 Form and open it in your online editor.

- In the field designated for the name of the seller, enter the complete legal name of the seller involved in the transaction.

- Provide the seller's complete address, including street address, city, state, and ZIP code.

- Enter the date you are filling out the certificate in the specified section to document when the resale certificate is being issued.

- In the field for the Hawaii G.E./Use Identification Number, input the identification number assigned to the purchaser under the General Excise Tax Law.

- Describe the nature and character of the purchaser's business in detail, providing specific information about the type of goods or services offered.

- Acknowledge that until the certificate is revoked, it applies to all sales of tangible personal property purchased from the seller, except where otherwise specified in writing.

- Confirm that all applicable sales will be considered wholesale sales as defined under section 237-4, HRS.

- Fill in the name and address of the purchaser, ensuring accuracy in the provided details.

- Identify the type of organization that the purchaser represents, noting whether it is a corporation, partnership, or individual.

- Have the authorized person sign the certificate, including their title or source of authority to validate the document.

- Once the form is complete, save the changes made to the document. You can download, print, or share the G 17 Form as needed.

Complete your G 17 Form online today for an efficient resale transaction.

You must register for VAT in the UK if you're: a UK seller selling goods as a business activity in the UK, and your business's VAT taxable turnover is more than £85,000 a year. an overseas seller and the online marketplace provides you with the VAT details of a business customer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.