Loading

Get What Is A 571 L Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is A 571 L Form online

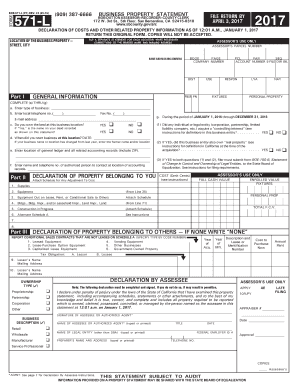

Filling out the What Is A 571 L Form online does not have to be a daunting task. This guide will provide you with step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Begin by completing the general information section. This includes providing your type of business, local telephone number, and email address.

- Indicate whether you own the land at your business location by selecting 'Yes' or 'No.' If 'Yes', verify that the name on your deed matches the statement.

- Enter the date when you started your business at this location. If your business name or location has changed from last year, include the former name and/or location.

- Provide the location of your general ledger and related accounting records, including the ZIP code.

- List the name and telephone number of an authorized person to contact at the location of the accounting records.

- Complete the declaration of property belonging to you, indicating whether any individual or legal entity has acquired a controlling interest in your business.

- Fill out the costs related to various categories such as equipment, tools, and personal property. Ensure you include relevant details such as year of acquisition and cost.

- Add totals where indicated, ensuring the figures correspond with the respective sections of the form.

- Complete the declaration section by signing and providing the name and title of the person completing the form. Ensure to include the date.

- After reviewing all information for accuracy, save your changes, download, or print the form for submission.

Complete your documents online to streamline the process.

This 571 L is the form that companies' file with their local county assessor. This lists of all of their non-real estate related property and equipment (machinery, computers etc.). The county assesses a tax on this equipment equal to about 1.11% of its depreciated value.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.