Get Ri Tdi-3p 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI TDI-3P online

Filling out the RI TDI-3P form online is an essential step for individuals seeking temporary disability benefits. This guide provides clear and detailed instructions to help you successfully complete the form, ensuring that you have all the required information at hand.

Follow the steps to complete the RI TDI-3P form with ease.

- Click ‘Get Form’ button to access the RI TDI-3P form and open it in your preferred editor.

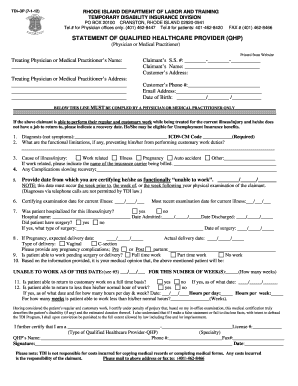

- Begin by entering the treating physician or medical practitioner's name and address in the designated fields. Ensure accuracy to prevent delays in processing.

- Fill in the claimant's Social Security number and full name. Also, complete the customer's address and phone number fields, along with their email address and date of birth.

- The section below the line must be completed solely by a qualified healthcare provider. This includes stating whether the claimant can perform their customary work and noting a potential recovery date.

- Provide the diagnosis and the corresponding ICD9-CM code. This information is mandatory and must accurately reflect the patient's condition.

- Indicate the cause of the illness or injury by selecting the appropriate option from the provided list. If work-related, specify the name of the insurance carrier.

- List any complications that may be slowing the recovery process in the space provided.

- Certify the period during which the claimant is considered unable to work. This should align with the week prior, during, or following the physician's examination.

- Complete details regarding the recent examination dates and whether the patient was hospitalized. Include the hospital name, admission, and discharge dates if applicable.

- Answer the questions regarding the patient's ability to work, including their capability to return to work full-time or part-time, along with suggested dates and hours.

- The final certification must be completed by the healthcare provider, including their name, specialty, license number, and signature, confirming the accuracy of the information provided.

- Review all entered information for accuracy and completeness. Once done, save your changes, download, print, or share the completed RI TDI-3P form as required.

Follow these detailed instructions to complete the RI TDI-3P form online and ensure your application for temporary disability benefits is submitted correctly.

The RI TDI tax is a specific payroll deduction imposed on Rhode Island residents to fund the state's Temporary Disability Insurance program. This tax allows employees to access much-needed benefits if they become unable to work due to injury or illness. Understanding the RI TDI-3P tax can help you plan better and navigate your contributions effectively. For detailed information, consider using platforms like USLegalForms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.