Loading

Get Stc Segregated Cost Computation Sheet (s.f. Costs)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the STC Segregated Cost Computation Sheet (S.F. Costs) online

This guide provides a step-by-step approach to filling out the STC Segregated Cost Computation Sheet (S.F. Costs) online. Designed for users of all experience levels, this comprehensive resource will help ensure accurate completion of the form.

Follow the steps to accurately complete the form online.

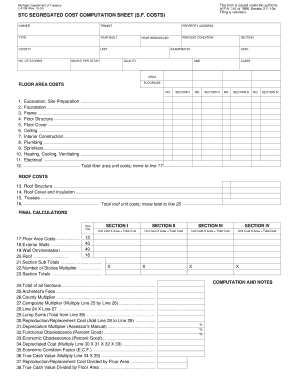

- Click the ‘Get Form’ button to access the STC Segregated Cost Computation Sheet and open it for editing.

- Begin by filling in the 'Owner' and 'Tenant' fields with the relevant names. These fields identify the parties involved in the cost computation.

- Specify the 'Type' of property by selecting the appropriate category. This ensures the computation aligns with the specific property classification.

- Fill out the 'Year Built' and 'Year Remodeled' fields to provide context on the condition and age of the property.

- Enter the 'County' in which the property is located; this affects the computation depending on local regulations.

- Complete the 'Property Address' to provide a precise location for the property being assessed.

- Indicate the 'Unit' and number of 'Stories' to add detail regarding the building structure, which is crucial for calculations.

- Assess and fill in the 'Percent Condition' and 'Quality' to describe the current state of the property.

- Use the sections outlined (Section I to Section IV) to enter costs associated with different parts of the property such as Foundation, Electrical, and Roof.

- Calculate and enter total costs by multiplying unit costs by area for each line item within the sections.

- Proceed to the 'Final Calculations' section, where you will sum up all section totals and apply necessary multipliers, including Architect's Fees and County Multipliers.

- Review the 'Computation and Notes' section to document any additional costs or considerations. Add lump sum additions where applicable.

- Finally, once all information has been accurately entered and reviewed, save changes, download, print, or share the completed form as required.

Complete your STC Segregated Cost Computation Sheet online today.

Cost segregation is a tax planning tool that gives real estate investors the chance to accelerate the depreciation of their investment properties. By doing this, they reduce their annual federal and state income tax payments, potentially freeing up their money for other investments or purchases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.