Loading

Get Individual Income Tax Net Operating Loss Computation It-40nol

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Individual Income Tax Net Operating Loss Computation IT-40NOL online

Filling out the Individual Income Tax Net Operating Loss Computation IT-40NOL online can be a straightforward process when you have the right guidance. This user-friendly guide will walk you through each step, ensuring you complete the form accurately and efficiently.

Follow the steps to complete your IT-40NOL form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

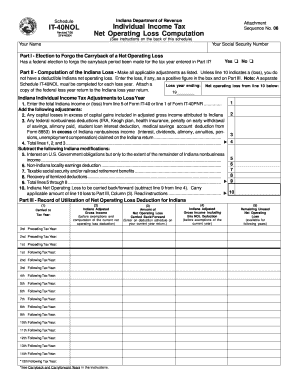

- Begin by entering your name and Social Security Number at the top of the form. This is essential for identification and tracking purposes.

- In Part I, indicate whether you have made a federal election to forgo the carryback period for the tax year entered in Part II. Check 'Yes' or 'No' accordingly.

- Move to Part II, where you will compute the Indiana loss. Start by entering the total Indiana income or loss from line 5 of Form IT-40 or line 1 of Form IT-40PNR.

- Add any applicable adjustments. For example, include capital losses exceeding capital gains or federal nonbusiness deductions that exceed Indiana nonbusiness income.

- Total the adjustments by adding lines 1, 2, and 3. This total will help determine your adjusted gross income.

- Subtract the Indiana modifications listed in lines 5 through 8 from your total in line 4. These modifications include interest on U.S. Government obligations and non-Indiana locality earnings.

- The result will give you the Indiana Net Operating Loss to be carried back or forward. Transfer this amount to Part III, Column (3).

- In Part III, you will need to record the utilization of the net operating loss deduction. Fill in the tax years and the corresponding Indiana adjusted gross income for those years, both before and after the NOL deduction.

- Finally, ensure that you save your changes, download, print, or share the form as required.

Start filling out your Individual Income Tax Net Operating Loss Computation IT-40NOL online today!

A Net Operating Loss (NOL) Carryforward allows businesses suffering losses in one year to deduct them from future years' profits. Businesses thus are taxed on average profitability, making the tax code more neutral.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.