Loading

Get Gst524

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst524 online

Filling out the Gst524 form online can be straightforward when you understand its structure and requirements. This guide will help you navigate through the various sections of the form and provide you with the necessary steps to ensure a successful submission.

Follow the steps to complete the Gst524 form with ease.

- Press the ‘Get Form’ button to access the Gst524 form and open it in your preferred editor.

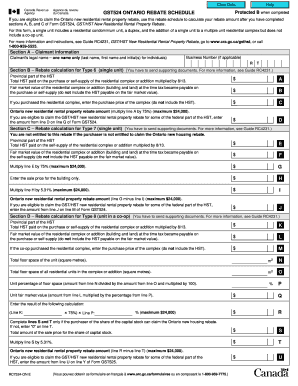

- In Section A, provide your claimant information. Enter your legal name as an individual or business and include your Business Number if applicable.

- Proceed to Section B to calculate your rebate for Type 6 (single unit). Fill in the total HST paid and the fair market value of the residential complex. Then, input the purchase price if applicable.

- Continue to Section C for the rebate calculation for Type 7 (single unit). Similar to Section B, fill in the HST paid and fair market value, and include the sale price.

- Move to Section D, which requires calculations for Type 8 (unit in a co-op). Provide similar information as in previous sections, focusing on the unit percentage of floor space.

- In Section E, complete the rebate calculations for Type 6 and Type 7 for multiple unit residential complexes. Record necessary details and aggregate the totals as instructed.

- For Section F, provide the calculations for Type 9A and 9B, ensuring you enter the HST paid and fair market value accurately to determine the rebate amounts.

- Review all sections thoroughly to ensure accuracy. Once completed, save the changes, and you can download, print or share the form as required.

Start filling out your Gst524 form online today for a smoother application process.

You are not required to pay the Ontario portion (8%) of the HST on items such as books, children's clothing and footwear, children's car seats and car booster seats, diapers, qualifying food and beverages, and newspapers. The Canada Revenue Agency administers the rebate on behalf of the Government of Ontario.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.