Loading

Get Or 40

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Or 40 online

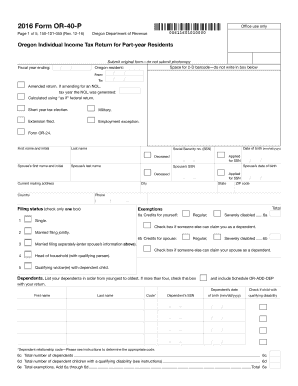

This guide provides a thorough overview on how to fill out the Oregon Individual Income Tax Return for Part-year Residents (Form OR-40) online. It covers each section of the form, offering step-by-step instructions designed to be clear and accessible for all users.

Follow the steps to complete your Or 40 form online with ease.

- Press the ‘Get Form’ button to obtain the Or 40 and access it in an editable format.

- Begin by entering your personal information. Fill in your first name, initial, and last name, as well as the corresponding details for your spouse if applicable.

- Input your current mailing address, including city, state, ZIP code, and phone number.

- Specify the fiscal year for your tax return by entering the appropriate dates in the designated fields.

- Indicate if you are amending the return, and if so, provide the tax year for the NOL.

- Select your filing status by checking the appropriate box (e.g., single, married filing jointly, head of household).

- List your dependents in the order from youngest to oldest and include their Social Security numbers and dates of birth as required.

- Enter your total income in the relevant fields. This includes wages, taxable interest, and any other applicable income.

- Complete the adjustments section by entering any adjustments to your income, such as IRA contributions or education deductions.

- Fill out the deductions section, determining whether you are itemizing or using the standard deduction.

- Calculate your Oregon tax by following the prompts and entering the amounts derived from your calculations.

- Review the payments and refundable credits section, entering any Oregon tax withheld or prior year credit applied.

- Finalize the form by reviewing all entered information for accuracy. You can then save your changes, download, print, or share the completed form as necessary.

Complete your Or 40 form online today to ensure accurate and timely submission.

Note: You don't need to request an Oregon extension unless you owe Oregon tax. If you need an Oregon filing extension, request the extension based upon your extension payment method: Electronic payments. Submit your payment prior to the return due date, selecting the “Return payment” type.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.