Loading

Get If Your Completed Return And All The Vat

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

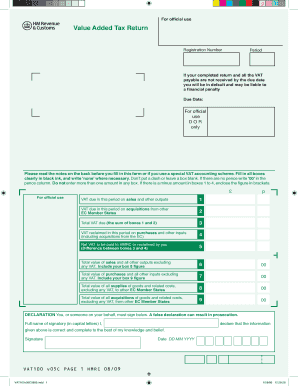

How to fill out the If Your Completed Return And All The VAT online

Filling out the If Your Completed Return And All The VAT form accurately is crucial for ensuring compliance with VAT regulations. This guide provides clear, step-by-step instructions tailored to help users of all experience levels complete the form correctly and efficiently.

Follow the steps to complete your VAT return online.

- Click ‘Get Form’ button to access the VAT return form online.

- Enter your registration number in the designated field. Ensure this matches the number issued to you by HMRC.

- Indicate the period for which you are filing the VAT return. This is usually the accounting period specified for your VAT returns.

- In box 1, enter the VAT due in this period on sales and other outputs. This amount reflects the VAT you charged on sales.

- For box 2, input the VAT due in this period on acquisitions from other EC Member States, reflecting your purchases from VAT registered suppliers within the EU.

- Calculate the total VAT due by summing the amounts from boxes 1 and 2, and enter this figure in box 3.

- In box 4, input the VAT reclaimed this period on purchases and other inputs, including any acquisitions from the EC.

- Determine the net VAT by subtracting the amount in box 4 from the total in box 3. Record the difference in box 5 to reflect how much is owed or refundable.

- Complete box 6 with the total value of your sales and outputs, excluding VAT, ensuring to include values reported in box 8.

- In box 7, record the total value of your purchases and inputs, excluding VAT, including amounts shown in box 9.

- Enter the total value of supplies to other EC Member States in box 8, ensuring no VAT is included.

- Finally, input in box 9 the total value of goods acquired from other EC Member States, also excluding VAT.

- Sign and date the declaration to confirm that the information provided is correct to the best of your knowledge.

- After completing the form, save your changes, download a copy for your records, print, or share as necessary.

Complete your VAT return online today to ensure timely and accurate submission.

A VAT Return is a form you fill in to tell HM Revenue and Customs ( HMRC ) how much VAT you've charged and how much you've paid to other businesses. You usually need to send a VAT Return to HMRC every 3 months.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.