Loading

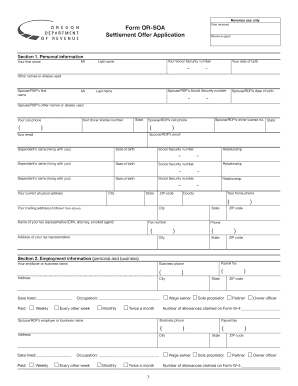

Get Form Or-soa, Oregon Settlement Offer Application, 150-101-157 - Oregon

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form OR-SOA, Oregon Settlement Offer Application, 150-101-157 - Oregon online

Filling out the Oregon Settlement Offer Application (Form OR-SOA) can be a critical step for taxpayers facing difficulties in settling their tax debts. This guide provides clear, step-by-step instructions to help you complete the application accurately and efficiently.

Follow the steps to successfully complete your Oregon Settlement Offer Application.

- Press the ‘Get Form’ button to access the Oregon Settlement Offer Application and open it for editing.

- Begin with Section 1: Personal information. Fill out all fields completely, including all members of your household. Make sure to provide your Social Security number, date of birth, and contact details.

- Move to Section 2: Employment information. Provide details about your employment or business, including your employer's name, address, and your occupation.

- Complete Section 3: General financial information. List all your bank accounts, assets, liabilities, and general financial details accurately. Ensure you attach supporting documents as required.

- In Section 4: Assets and liability analysis, transfer the totals from Section 3 into the respective fields. Calculate the total value of your immediate assets and real property equity.

- Proceed to Section 5: Monthly income and expense analysis. Enter your income, separating personal and business, and provide documentation for income sources.

- In Section 6: Settlement offer calculations, compute your disposable income and total settlement offer amount using the formulas provided. Remember to include a 5 percent nonrefundable payment based on the settlement offer amount.

- Conclude with Section 7: Additional information. Optional but recommended, you can provide any other details relevant to your application.

- Sign and date the taxpayer agreement and authorization to use credit reports. Make sure both you and your spouse or registered domestic partner sign if applying jointly.

- Before submission, review your application to ensure all fields are complete, and print the final version. Then, save changes, and if desired, download, print, or share the application.

Complete your settlement offer application online today and take the first step to resolving your tax debt.

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS). Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.