Loading

Get Chapter 9 Management Of Economic Exposure Suggested ... - Cob Unt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CHAPTER 9 MANAGEMENT OF ECONOMIC EXPOSURE SUGGESTED ... - Cob Unt online

This guide provides clear, step-by-step instructions for completing the CHAPTER 9 MANAGEMENT OF ECONOMIC EXPOSURE SUGGESTED form online. Whether you are familiar with economic exposure concepts or new to them, this guide will help you navigate the form with ease.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to access the document and initiate the filling process.

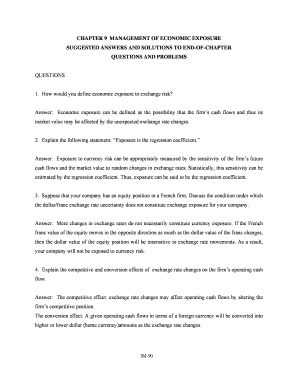

- Begin by reviewing the definition of economic exposure to exchange risk. This section should provide clarity on how exchange rate changes can impact a firm's cash flows.

- In the next field, explain the statement regarding exposure as the regression coefficient, focusing on how this measurement relates to cash flow sensitivity.

- Discuss the conditions under which exchange rate uncertainty may not affect your company’s exposure, using the example from the document regarding equity positions.

- Detail the competitive and conversion effects of exchange rate changes on operating cash flow, ensuring to note how these factors can alter a firm's market position.

- Outline the determinants of operating exposure. Identify factors such as market structure and a firm's sourcing strategy that can mitigate exchange rate impact.

- Evaluate the implications of purchasing power parity on operating exposure, discussing how inflation rate differentials between countries play a role.

- Recommend strategic measures that firms like GM can adopt to handle currency risks in international markets.

- Contrast the advantages and disadvantages of financial hedging versus operational hedges, providing users with practical considerations.

- Finish by discussing how maintaining multiple manufacturing sites may serve as a hedge against exchange rate exposure and analyzing related costs.

- Conclude by providing evaluation criteria on diversifying business lines as a hedge against foreign currency exposure.

- Finally, ensure to review your responses for accuracy before submitting the form. Users can save changes, download, print, or share the completed form.

Take action now and complete your documents online for a smoother experience.

This deviation in the worth of currency between the U.S. Dollar and the Thai Baht is called operation exposure, a term used to describe the risk associated with doing business when foreign exchanges are necessary. A company has to decide how much risk it is willing to incur when dealing with foreign exchange rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.