Loading

Get Contractors ' Excise Tax Return Worksheet/instructions - State Sd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

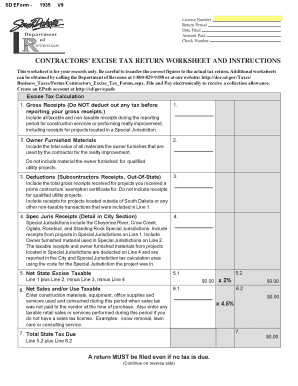

How to fill out the Contractors' Excise Tax Return Worksheet/Instructions - State SD online

This guide provides clear instructions on how to accurately complete the Contractors' Excise Tax Return Worksheet online. Follow these steps to ensure you submit the correct information and stay compliant with South Dakota tax regulations.

Follow the steps to successfully complete your tax return worksheet.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your license number in the designated field to identify your account.

- Specify the return period for which you are filing this tax return, ensuring accuracy regarding the date range.

- Input the date you are filing the return. This date should reflect when you are submitting your payment.

- Document the amount you are remitting by entering the total tax due in the relevant field.

- Include your check number if you are submitting a payment via check, which helps in tracking your payment.

- In the 'Excise Tax Calculation' section, input the total gross receipts without deducting any tax amounts.

- For owner-furnished materials, provide the total value of materials supplied by the property owner.

- List any deductions for subcontractor receipts or projects outside of South Dakota, noting these do not contribute to tax.

- Input the taxable receipts from projects located in Special Jurisdictions to ensure proper tax compliance.

- Calculate the Net State Excise Taxable by adding your total gross receipts and owner-furnished materials, then subtracting deductions.

- Enter details of taxable sales or services where sales tax was unpaid in the 'Net Sales and/or Use Taxable' section.

- Compute the total tax due by adding your calculated amounts from the sections above.

- Complete the 'City & Special Jurisdiction Tax Calculation Detail' section with relevant city or jurisdiction data.

- Add up the total city and special jurisdiction tax, incorporating all previous entries.

- Review any penalties or interest applicable based on payment timing.

- Compile the total amount due by summing the total tax due, penalties, and any previous credits or balances.

- Finalise your amount remitted in the last section, indicating what you are enclosing with the return.

- Check all entries for accuracy before finalising the document.

- Save changes, download a copy for your records, and print the return for mailing.

Complete your Contractors' Excise Tax Return online today to ensure accurate and timely filing.

South Dakota charges a 4% excise sales tax rate on the purchase of all vehicles. In addition, for a car purchased in South Dakota, there are other applicable fees, including registration, title, and plate fees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.