Loading

Get W4 Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W4 CT online

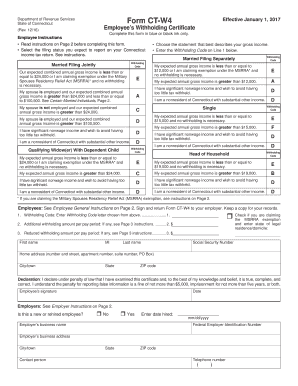

The W4 CT, or Employee's Withholding Certificate, is a crucial form for Connecticut employees to ensure appropriate income tax withholding from their wages. This guide will provide you with a step-by-step approach to fill out the W4 CT online effectively.

Follow the steps to correctly complete the W4 CT form.

- Press the ‘Get Form’ button to acquire the W4 CT form and open it in your preferred format.

- Review the instructions provided on the second page of the form before starting to fill it out. It's essential to understand the requirements to avoid mistakes.

- Select your expected filing status for your Connecticut income tax return. This could be 'Single', 'Married Filing Jointly', 'Married Filing Separately', 'Qualifying Widow(er) with Dependent Child', or 'Head of Household'.

- Choose the statement that best describes your expected gross income and enter the corresponding Withholding Code from the options provided.

- If applicable, specify any additional withholding amount you wish to be deducted per pay period in the designated field.

- If you are reducing your withholding amount per pay period, enter that amount in the appropriate field.

- Input your personal information, including your first name, middle initial, last name, Social Security Number, home address, city, state, and ZIP code.

- Sign and date the form, certifying that the information provided is true and correct to the best of your knowledge.

- Save your completed W4 CT form, ensuring that you keep a copy for your records. You may download, print, or share it as necessary.

Complete your W4 CT form online today to ensure accurate withholding of your Connecticut income tax.

Purpose: Form CT‑W4P is for Connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of Connecticut income tax to withhold. Your options depend on whether the payment is periodic or nonperiodic.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.