Loading

Get Payroll Discrepancy

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Discrepancy online

This guide provides comprehensive instructions on how to effectively fill out the Payroll Discrepancy form online. By following these steps, users can ensure that their discrepancies are reported accurately and efficiently.

Follow the steps to complete the Payroll Discrepancy online form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

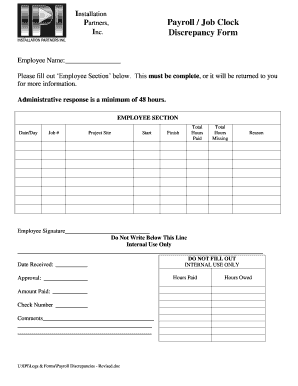

- In the 'Employee Section,' start by entering your name in the designated field labeled ‘Employee Name.’ Ensure this field is filled out completely, as the form will be returned if this information is missing.

- Next, provide the date and day corresponding to the hours in question.

- Input your job number accurately in the field labeled ‘Job #.’ This information is essential for tracking your hours.

- Fill in the ‘Project Site’ to identify where the work was performed.

- Record the start time and finish time of your work in the 'Start' and 'Finish' fields, respectively.

- Calculate and enter the 'Total Hours Paid' for the period you are addressing.

- Next, specify the 'Total Hours Missing' to indicate any discrepancies.

- Lastly, clearly state the 'Reason' for the discrepancy in the provided space.

- Sign the form in the 'Employee Signature' section to validate the information provided.

- After completing all sections, save your changes and choose to download, print, or share the final document as needed.

Ensure to submit your Payroll Discrepancy form online to resolve any issues promptly.

Send your corrected FPS by the 19th of the tax month after you sent your original FPS . HMRC will apply the correction to the right month. If the wrong date was in different tax month, you must realign your payroll to the correct tax period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.