Loading

Get Uk Form Sa100 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK Form SA100 online

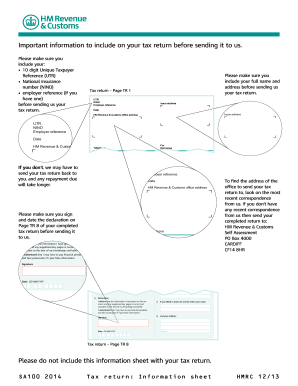

Filling out the UK Form SA100 online can seem daunting, but this comprehensive guide will walk you through each step of the process. By following these instructions, you can ensure that your tax return is submitted accurately and efficiently.

Follow the steps to complete your UK Form SA100 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Unique Taxpayer Reference (UTR), National Insurance number (NINO), and, if applicable, your employer reference. This information is crucial for identifying your tax records.

- Complete the income sections by entering your taxable income, including any pensions, interest, or dividends. Be sure to follow the specific instructions for each income type and round figures to the nearest pound.

- Review your entries carefully to ensure that all information is correct. Cross out any mistakes and write the correct information clearly using black ink and capital letters.

- Upon completing the form, you will have options to download, print, or share your tax return online. Ensure you follow the necessary steps to submit it before the deadline to avoid any penalties.

Don't wait any longer; start filling out your UK Form SA100 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In the UK, tax forms like the UK Form SA100 are generally not available at post offices. Instead, these forms can be accessed online or may be available through HM Revenue and Customs offices. Online platforms offer a broader range of documents for your tax needs, making access easier.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.