Loading

Get 201403 Cfpb Loan-estimate Refinance-sample-h24d.pdf - Gonms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 201403 Cfpb Loan-estimate Refinance-sample-H24D.pdf - Gonms online

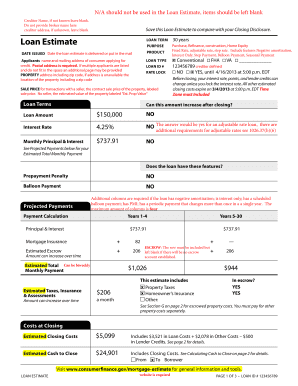

Filling out the 201403 Cfpb Loan-estimate Refinance-sample-H24D.pdf - Gonms online is an essential step for anyone looking to refinance their loan. This guide will provide you with a clear and supportive walkthrough of each section of the form, ensuring you have all the necessary information at your fingertips.

Follow the steps to complete your loan estimate efficiently.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Fill in the creditor name if known. If you do not know the creditor name, leave this section blank.

- Enter the creditor address. If unknown, this can also be left blank.

- Provide the date issued, which is the date the loan estimate is delivered or mailed.

- Complete the applicant's name and mailing address. A postal address is required. If there are multiple applicants and their names do not fit, attach an additional page.

- Indicate the property address, including the zip code. If the exact address is unavailable, provide the location of the property with the corresponding zip code.

- Select the loan type, loan ID number, and rate lock information as applicable.

- For the sale price, enter the contract sale price of the property for transactions with a seller. If there is no seller, provide the estimated property value.

- Fill out the loan terms section, specifying the loan term length and the type of loan features (such as fixed or adjustable rates).

- Provide the loan amount, interest rate, and monthly principal and interest payment.

- Check if the loan has features like prepayment penalties or balloon payments. Add any additional specific payments required.

- Complete the projected payments section to show estimates for the monthly payment and escrow information.

- Record the estimated closing costs detailed section, including loan costs, other costs, and estimated cash to close.

- After filling out all necessary information, review the document for accuracy. You can then save the changes, download, print, or share the completed form.

Take the next step towards refinancing by completing your loan estimate online.

Key terms on Loan Estimate page 3: In 5 years — The total amount you'd pay toward the loan in five years, including principal, interest, mortgage insurance, and upfront costs. Annual percentage rate (APR) — Your combined interest and loan costs, represented as a percentage of the loan amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.