Get Canada Rc1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC1 online

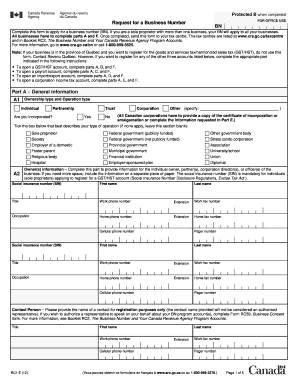

The Canada RC1 form is essential for individuals and businesses seeking to obtain a business number (BN) in Canada. This guide is designed to provide clear, step-by-step instructions on how to complete the RC1 online, ensuring that users can efficiently navigate the process regardless of their legal experience.

Follow the steps to successfully complete the Canada RC1 online form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part A, which covers general information. Here, identify your ownership type (individual, partnership, corporation, etc.) and provide the necessary answers to the questions. Ensure to complete the contact details for each business owner accurately.

- In Part A3, provide the identification of your business including its name, physical location, and mailing address if different. Also, indicate your language preference and specify if you wish to register as a third party.

- For Part A4, describe your major business activity in detail. Be specific about your main products or services and their estimated revenue percentages.

- Complete Part A5 regarding GST/HST information. Answer the questions regarding your business activities and whether you will charge GST/HST.

- If applicable, move to Part B for GST/HST account information, detailing your sales in Canada, fiscal year-end, and any direct deposit information related to refunds.

- If you are applying for a payroll account, complete Parts C1 and C2 with employee payment details and maximum employee numbers.

- For import/export accounts, continue to Part D. Provide the required details about the type of account and any goods involved.

- In Part E, complete the corporation income tax account part by providing necessary identification and incorporation details.

- Finally, complete Part F by certifying the information provided. Ensure that the appropriate party signs and dates the form.

- After completing all sections, users can save changes, download, print, or share the form as needed.

Complete your documentation online to streamline your business registration process.

Get form

When separated, you need to file your taxes based on your current situation. If you lived together earlier in the year, you might have to file jointly for that portion and then individually afterward. Understanding your obligations under Canada RC1 is crucial during this transition. UsLegalForms can offer clear guidance on how to approach your tax filing during separation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.