Loading

Get Supplementary Application Form With Adviser Charge Agreement - Aviva Co

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Supplementary Application Form With Adviser Charge Agreement - Aviva Co online

This guide provides clear instructions for filling out the Supplementary Application Form With Adviser Charge Agreement from Aviva Co. By following these steps, you will ensure that you complete the form accurately and efficiently, allowing for a smooth processing of your application.

Follow the steps to correctly fill out the form online.

- Click the ‘Get Form’ button to retrieve the Supplementary Application Form With Adviser Charge Agreement. Follow the prompts to open the document in your editing interface.

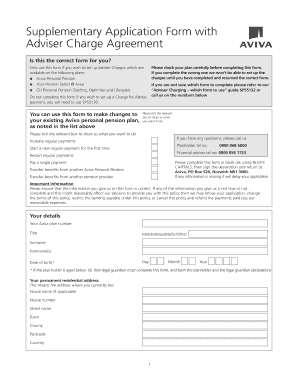

- Begin with the 'Is this the correct form for you?' section. Review your specific Aviva plan to ensure this is the appropriate form. Only use this if you are setting up Adviser Charges associated with Aviva Personal Pension plans.

- Fill in 'Your details' accurately, including your Aviva plan number, title, surname, forename(s), and date of birth. If the planholder is under 18, include legal guardian details and ensure both sign the declaration.

- Provide your permanent residential address. This should reflect your current living situation with appropriate details including house number, street name, town, county, postcode, and country.

- Complete the 'Contact details' section with your telephone number, mobile number, and email address. This information is essential for communication regarding your application.

- Indicate your current employment status by ticking the relevant box. Additionally, confirm your residency status in relation to the UK.

- In the 'Your payments' section, specify whether you are increasing, starting, or restarting your regular payments, or making a single payment. Follow the guidance on calculating gross amounts for contributions.

- If applicable, complete the 'Transferring from another pension scheme' section. Provide details of the schemes you are transferring from and ensure you discuss with a financial adviser if needed.

- Review the 'Adviser Charge Agreement' section. Fill in necessary details regarding your financial adviser and the charges to be paid. Confirm the amounts and frequencies for both initial and ongoing adviser charges.

- Sign and date the 'Declaration' section, ensuring all information provided is accurate. If applicable, have your employer and legal guardian sign the necessary declarations.

- To finalize, ensure all fields are filled correctly and that you save your changes. Depending on your needs, download, print, or share the completed form as required.

Complete your Supplementary Application Form With Adviser Charge Agreement - Aviva Co online today to ensure timely processing of your application.

Scheme annual management charge ('AMC') It is the Aviva administration charge for running your account. The Scheme AMC is calculated daily, based on the value of your investments. 0.23% each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.