Loading

Get Residency Certification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Residency Certification Form online

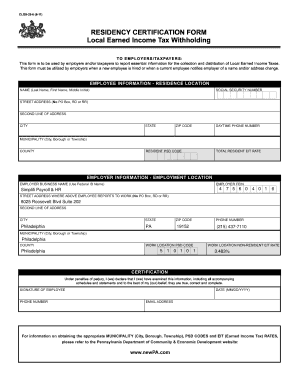

This guide provides you with clear instructions on how to complete the Residency Certification Form online. By following these steps, you will ensure that all essential information is accurately reported for the collection and distribution of local earned income taxes.

Follow the steps to successfully complete the form online.

- Click 'Get Form' button to obtain the Residency Certification Form and open it in your preferred online document editor.

- Fill in the employee information section, including your name (last name, first name, middle initial), social security number, and street address. Ensure that you do not use a P.O. Box, rural delivery, or route number.

- Provide the second line of your address, city, state, and ZIP code. Also, include your daytime phone number for contact purposes.

- Indicate your municipality (city, borough, or township) and county, as well as your resident PSD code and total resident EIT rate.

- Next, complete the employer information section by entering your employer's business name (as per Federal ID), employer FEIN, and the address where you report to work, avoiding P.O. Box, rural delivery, or route number.

- Fill in the details for the second line of the employer's address, city, state, ZIP code, and the employer's phone number.

- Provide the municipality and county of the employment location, along with the work location PSD code and work location non-resident EIT rate.

- In the certification section, declare that the information you've provided is true, correct, and complete under penalties of perjury. Sign the form, include your phone number, and date it in MM/DD/YYYY format.

- Lastly, enter your email address if requested, then review your form for accuracy. You can now save changes, download, print, or share the form as needed.

Complete your documents online with ease by utilizing this guide.

This form is to be used by employers and/or taxpayers to report essential information for the collection and distribution of Local Earned Income Taxes. This form must be utilized by employers when a new employee is hired or when a current employee notifies employer of a name and/or address change.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.