Loading

Get Az 5000 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Az 5000 Form online

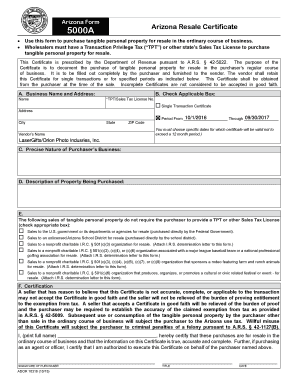

The Az 5000 Form is used for the purchase of tangible personal property for resale in the ordinary course of business. This guide offers a clear, step-by-step approach to completing the form online, ensuring accuracy and compliance with state regulations.

Follow the steps to successfully complete the Az 5000 Form online.

- Click the ‘Get Form’ button to access the Az 5000 Form. Once it opens, you will be able to fill out the necessary information.

- Enter the business name and address in section A. Make sure to include the complete name, address, city, state, and ZIP code of your business.

- In section B, check the applicable box for your TPT or Sales Tax License number. You must also select whether this is a 'Single Transaction Certificate' or for a specific period. If selecting a period, fill in the start and end dates, ensuring they do not exceed twelve months.

- In section C, provide a precise description of your business activities. This helps clarify the nature of your business for the vendor reviewing the certificate.

- Section D requires you to describe the property you are purchasing. Be detailed to ensure the vendor understands the items involved in the transaction.

- In section E, check all applicable boxes regarding sales that do not require the purchaser to provide a TPT or Sales Tax License. If necessary, attach an I.R.S. determination letter to the form for specific non-profit sales.

- Complete the certification section at the end of the form. Print your full name, sign, enter your title (if applicable), and the date. Ensure all information is accurate and true to avoid penalties.

- Finally, you can save the changes to the form, download it for your records, print a copy for submission, or share it directly with the vendor.

Start filling out your Az 5000 Form online today for efficient and accurate processing.

The purpose of the certificate is to document tax-exempt transactions with qualified purchasers. It is to be filled out completely by the purchaser and furnished to the vendor. The vendor shall retain this Certificate for single transactions or for specified periods as indicated below.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.