Loading

Get Form Ppt-g-fs - Gasoline Floor Stock. Form Ppt -g - Inv - Gasoline Inventory Report - State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form PPT-G-FS - Gasoline Floor Stock. Form PPT -G - INV - Gasoline Inventory Report - State Nj online

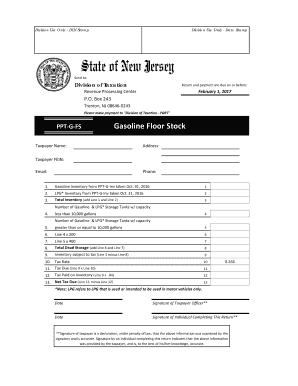

Filling out the Form PPT-G-FS - Gasoline Floor Stock is an essential task for individuals and companies holding gasoline and liquefied petroleum gas in storage for sale. This guide will provide you with a step-by-step approach to successfully complete the form online.

Follow the steps to fill out your form accurately and efficiently.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin with the taxpayer name and address. Ensure that you provide accurate contact details, including the Taxpayer FEIN, email, and phone number.

- Locate Line 1 on the form and input the gasoline inventory figures from your previously submitted PPT-G-INV form as of October 31, 2016.

- On Line 2, enter the inventory for liquefied petroleum gas (LPG) from the same report.

- Add the amounts from Line 1 and Line 2 to calculate the total inventory, and record this figure on Line 3.

- For Line 4, input the number of gasoline and LPG storage tanks that have a capacity of less than 10,000 gallons.

- On Line 5, indicate the number of gasoline and LPG storage tanks that have a capacity of 10,000 gallons or more.

- Calculate the dead storage allowance for tanks under 10,000 gallons by multiplying the number from Line 4 by 200, and enter this value on Line 6.

- For tanks equal to or greater than 10,000 gallons, multiply the number from Line 5 by 400, and put this on Line 7.

- Add the values from Line 6 and Line 7 to determine the total dead storage, recorded on Line 8.

- Subtract the total from Line 8 from the total inventory on Line 3. Fill in this resultant figure on Line 9.

- Input the applicable tax rate, noted as 26.6 cents per gallon on Line 10.

- Calculate the tax due by multiplying the figure on Line 9 by the tax rate from Line 10. Document this amount on Line 11.

- Enter the tax previously paid on the inventory from Line 9 using a rate of 4 cents per gallon on Line 12.

- Find the net tax due by subtracting the tax paid on inventory specified on Line 12 from the amount on Line 11. Enter this value on Line 13.

- Finally, review your entries for accuracy. Save changes, and utilize the options to download, print, or share the filled form as needed.

Complete your forms online today to ensure compliance and timely submission.

Today, New Jersey's 42.3-cent-per-gallon tax on gasoline and its 49.3-cent tax on diesel are among the nation's highest.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.