Loading

Get Fet Exemption Form.xlsx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FET Exemption Form.xlsx online

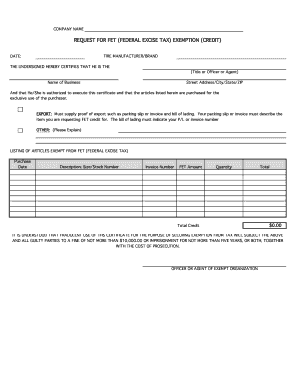

Filling out the FET Exemption Form is a crucial step for tire manufacturers seeking exemption from federal excise tax. This guide will provide you with clear, step-by-step instructions to ensure you accurately complete the form online.

Follow the steps to successfully complete the FET Exemption Form online.

- Click the ‘Get Form’ button to download the FET Exemption Form.xlsx and open it in your preferred editor.

- In the designated area, enter the full name of your business. Ensure that the name matches your official business registration.

- Fill out your business's street address, city, state, and ZIP code accurately. This information is vital for verification purposes.

- Specify the date when you are completing the form. This helps in tracking the timing of your exemption request.

- Indicate the title or position of the person completing the form, ensuring that they are authorized to perform this action on behalf of the business.

- List the articles for which you are requesting a Federal Excise Tax exemption. This includes the purchase date, description (size and stock number), invoice number, FET amount, quantity, and total credit for each item.

- If applicable, provide proof of export by attaching packing slips or invoices and bill of lading. Ensure these documents describe the items accurately and reference the invoice number.

- If seeking exemptions for other articles, provide a brief explanation in the designated area.

- Once all sections are filled out correctly, you can save your changes, and then download or print the completed form for your records. Sharing options may also be available if needed.

Complete your FET Exemption Form online today for a smooth submission process.

Related links form

Generally, this tax applies to trucks and chassis over 26,000 pounds. This does not include a truck's gross weight of 33,000 pounds. This tax also encompasses related parts and accessories such as tires. The body of a dump truck, eight cubic yards or fewer are included as a federal excise tax exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.