Loading

Get Form 83b Example

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 83b Example online

Filing the IRS Form 83b can be an essential process for individuals receiving unvested shares. This guide will help you navigate the various components of the Form 83b Example, providing step-by-step instructions for successful online completion.

Follow the steps to efficiently complete your Form 83b Example online.

- Click the ‘Get Form’ button to access the Form 83b Example. This will allow you to retrieve the necessary document for completion.

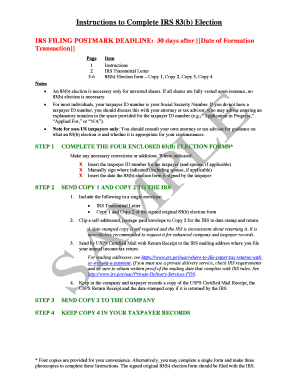

- Complete all four copies of the 83b election forms as enclosed in the document. Ensure all necessary corrections or additions are made for accuracy.

- Insert the taxpayer ID number for the taxpayer and any applicable spouse. Each individual needs to provide their respective taxpayer ID numbers.

- Manually sign where indicated for both the taxpayer and spouse, if applicable. Ensure to date the forms upon signing.

- Send Copy 1 and Copy 2 to the IRS. Place these copies along with the IRS transmittal letter in a single envelope. Clip a self-addressed, postage-paid envelope to Copy 2 for a date-stamped return.

- Mail your submission by USPS Certified Mail with Return Receipt to the IRS service center where you file your annual income tax return. Be sure to keep copies of your mailing receipts for your records.

- Send Copy 3 to the company involved. This is a necessary step to notify them of the election.

- Keep Copy 4 for your taxpayer records. It is important to maintain this copy for your own documentation.

Complete your Form 83b Example online today to ensure compliance with IRS regulations.

To file 83(b) shares on your tax return, the fair market value of the shares will be reported on a W-2 or 1099-NEC. All you need to do is match the figures from your employer to your tax return. Once the vesting period is over if you sell the shares you are subject to capital gains tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.