Loading

Get Sba Borrower's Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA Borrower's Certification online

Filling out the SBA Borrower's Certification is an important step for borrowers seeking a guaranteed loan from the U.S. Small Business Administration. This guide provides detailed instructions on how to complete the form online, ensuring you understand each section and requirement.

Follow the steps to successfully complete the SBA Borrower's Certification.

- Click ‘Get Form’ button to initiate the process and access the SBA Borrower's Certification form.

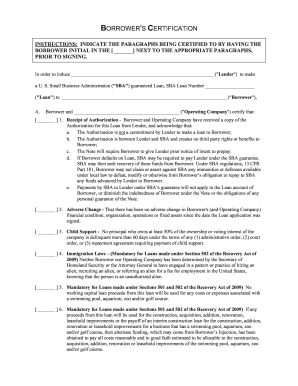

- Begin by identifying the sections of the form that require your initials. You will need to initial in the designated spaces next to each paragraph that you are certifying.

- In section A, certify the receipt of authorization by initialing next to paragraph 1, acknowledging that you have received the necessary documentation and understand the responsibilities associated with the loan.

- For paragraph 2, initial to confirm that there have been no adverse changes in your financial condition or operations since you submitted your loan application.

- Continue through each paragraph of section A, initialing as appropriate, including any declarations regarding child support, compliance with immigration laws, and adherence to environmental regulations.

- Move to section B, where you will certify ongoing commitments. Carefully read each item and initial to confirm your agreement, particularly concerning record keeping and compliance with tax obligations.

- Lastly, review section C, where you will affirm your intentions regarding distributions, ownership changes, and asset transfers. Be sure to initial beside each relevant clause.

- Once you have completed the form, review all sections for accuracy. Save your changes, and choose the option to download or print for your records or to share with the lender.

Complete your SBA Borrower's Certification online today to facilitate your loan process.

Related links form

Once your loan is approved, estimates are that it should take approximately 5-7 business days for your funds to become available.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.