Loading

Get Kmlrcc-205. Reporting Form - Carpenters205

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KMLRCC-205. Reporting Form - Carpenters205 online

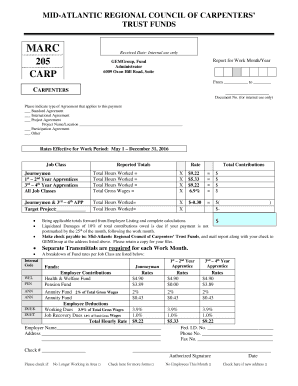

Filling out the KMLRCC-205 Reporting Form - Carpenters205 online is essential for accurate reporting of contributions and compliance with regulations. This guide provides clear, step-by-step instructions to help users complete the form efficiently, ensuring all necessary information is accurately reported.

Follow the steps to successfully complete the KMLRCC-205 Reporting Form online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Enter the received date in the designated field, which is for internal use only.

- Fill in the report for the work month and year, indicating the specific period of work covered by this report.

- Provide your contact information, including your name, address, phone number, and fax number.

- Select the type of Agreement that applies to this payment by checking the appropriate box: Standard Agreement, International Agreement, Project Agreement, Participation Agreement, or Other.

- Enter the project name and location if applicable, ensuring clarity in this section.

- Fill in the totals for each job class reported, including journeymen and apprentices, making sure to include the total hours worked and total gross wages.

- Calculate total contributions based on the rates effective for the work period, noted in the form.

- Include the employer’s name and federal identification number, and remember to indicate if the employer is no longer working in the area by checking the box.

- Complete the section for liquidated damages, if applicable, and ensure that you understand the consequences of late payments.

- Sign and date the form, indicating your authorization.

- Once all sections are completed, you can save the changes, download, print, or share the completed form as needed.

Start filling out your KMLRCC-205 Reporting Form online today to ensure timely reporting and compliance.

Act 205, the Distressed Municipal Pension Recovery Tax Act, was signed into law in 1984 and allows certain municipalities to increase their earned income tax rates to fund their municipal pension liabilities. The State of Pennsylvania must approve all requests to implement Act 205.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.