Loading

Get Form Townb Iowa Department Of Management Adopted

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form TOWNB Iowa Department Of Management ADOPTED online

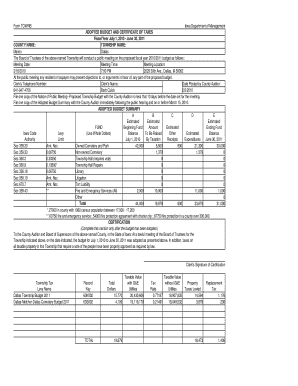

Filling out the Form TOWNB from the Iowa Department of Management is essential for adopting a budget for your township. This guide provides clear and supportive instructions to help you navigate the form effectively and ensure compliance with local regulations.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering the county name in the designated field. Ensure you correctly spell the name of the county to avoid any processing errors.

- Next, input the township name. This should match the official name used in local government documents.

- Enter the meeting date and time for the public meeting regarding the proposed fiscal year budget. Make sure this information is accurate and reflects the time set for the meeting.

- Fill in the meeting location, including the address of the venue where the public meeting will be held.

- Provide the clerk's name and contact number. This information is crucial for follow-up inquiries and should be current.

- Indicate the date when the information was posted by the county auditor. Ensure this is within compliance with the existing regulations regarding notice periods.

- Complete the adopted budget summary section by filling in each field with estimated amounts for fund balance, taxation to be raised, receipts, expenditures, and ending fund balance.

- In the certification section, confirm that the budget is adopted by including the signature of the clerk to validate the document.

- Once the form is completed, review all information for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your documents online today to ensure timely submission of your township budget.

Iowa has a 5.50 percent to 8.40 percent corporate income tax rate. Iowa has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.94 percent. Iowa's tax system ranks 38th overall on our 2023 State Business Tax Climate Index.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.