Loading

Get Attachment-727 - Computation Of Tax Differential.doc - Roads Nebraska

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Attachment-727 - Computation Of Tax Differential.doc - Roads Nebraska online

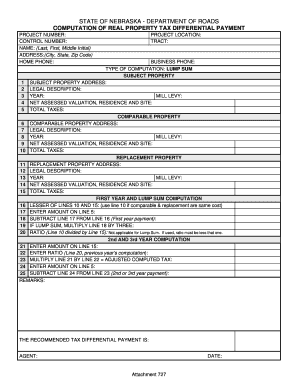

Filling out the Attachment-727 form is an essential step for calculating the tax differential payment related to real property in Nebraska. This guide provides clear instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to retrieve the document and open it for editing.

- Begin in the 'Project Number' section by entering the specific project number associated with your tax differential computation.

- Fill out the 'Control Number' field with the relevant control number to maintain proper tracking.

- In the 'Name' section, provide your last name, followed by your first name and middle initial.

- Complete the 'Address' area with your city, state, and zip code for accurate identification.

- Enter your home phone number in the designated field.

- Specify the 'Project Location' which corresponds to the area related to the property in question.

- Input the 'Tract' number to indicate the specific tract of land being assessed.

- Provide your business phone number if applicable, in the corresponding section.

- For 'Type of Computation', select 'Lump Sum' to indicate the computation type you are applying.

- In the 'Subject Property' section, enter the address, legal description, mill levy, year, net assessed valuation, and total taxes for the subject property.

- Move to the 'Comparable Property' section and fill in the comparable property's address, legal description, mill levy, year, net assessed valuation, and total taxes.

- Next, in the 'Replacement Property' section, provide the address, legal description, mill levy, year, net assessed valuation, and total taxes for the replacement property.

- For 'First Year and Lump Sum Computation', enter the lesser of lines 10 and 15, then enter the amount from line 5 and subtract line 17 from line 16 to calculate the first-year payment.

- If you have a lump sum, multiply line 18 by three to find the total lump sum payment.

- Record the ratio in this section only if relevant, ensuring it is less than one, as a ratio is not applicable for lump sum calculations.

- For the 2nd and 3rd year computations, enter the amount from line 15 and input the ratio from the previous year’s computation.

- Multiply line 21 by line 22 to obtain the adjusted computed tax for the subsequent years.

- Enter the amount from line 5 and subtract it from line 23 to calculate the payment for the 2nd or 3rd year.

- Add any remarks necessary for additional clarification or context about the computation.

- Finally, review all entered information for accuracy before saving changes, downloading, printing, or sharing the completed document.

Get started on your tax differential computations today by filling out the Attachment-727 online!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.