Loading

Get Form 4506 F

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4506 F online

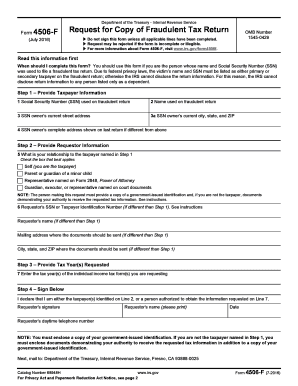

Filling out Form 4506 F correctly is essential for obtaining a copy of a fraudulent tax return. This guide will help you navigate each step of the process with clarity and support, ensuring you provide the required information without confusion.

Follow the steps to fill out Form 4506 F correctly online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In Step 1, provide the taxpayer information: Enter the Social Security Number (SSN) used on the fraudulent return, the name associated with the fraudulent return, the current street address of the SSN owner, the city, state, and ZIP code of the SSN owner, and any previous address shown on the last return if it differs from the current one.

- In Step 2, provide requestor information: Indicate your relationship to the taxpayer listed in Step 1 by checking the appropriate box. Then, enter your SSN or Taxpayer Identification Number (if different), your name (if it differs), and the mailing address details.

- In Step 3, specify the tax year(s) of the return(s) you are requesting by entering the relevant years.

- Finally, in Step 4, sign and date the form. Be sure to also provide a copy of your government-issued identification and any documents that establish your authority to request this information if you are not the taxpayer.

- Once you have filled out the form completely, save changes, download a copy, print it out, or share it as needed.

Begin filling out your Form 4506 F online today to request copies of your fraudulent tax return.

Form 4506-F (Rev. 8-2021) Instructions for Form 4506-F, Identity Theft Victim's Request for. Copy of Fraudulent Tax Return. Purpose of the form: Victims of identity theft should use this form to request a tax return transcript of a fraudulent return filed using their name and SSN as the primary or secondary taxpayer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.