Loading

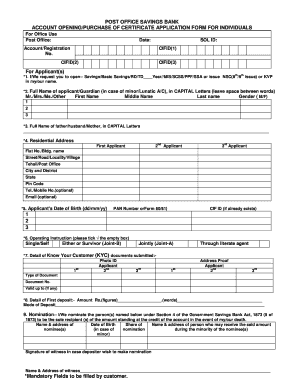

Get Post Office Savings Bank Account Opening/purchase Certificate Application Form For Individuals

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Post Office Savings Bank Account Opening/Purchase Certificate Application Form for individuals online

This guide provides clear, step-by-step instructions for filling out the Post Office Savings Bank Account Opening/Purchase Certificate Application Form for individuals online. By following these instructions, users can ensure a smooth application process.

Follow the steps to complete your application form online.

- Press the ‘Get Form’ button to access the Post Office Savings Bank Account Opening/Purchase Certificate Application Form for individuals.

- In the first section, specify the type of account you wish to open or the investment certificate you want to purchase by selecting from the available options: Savings, Basic Savings, Recurring Deposit, Time Deposit, Monthly Income Scheme, Senior Citizens Savings Scheme, Public Provident Fund, or a National Savings Certificate.

- Enter your full name or the guardian's name in capital letters, ensuring to separate each word with a space. Select your gender from the provided options.

- Provide the full name of your father, mother, or spouse in capital letters.

- Fill in your residential address, including flat number, street name, locality, city, state, and pin code. Include your telephone or mobile number and email address, if desired.

- Input your date of birth in the specified format (dd/mm/yy) and provide your PAN number or Form 60/61 if necessary.

- Select your preferred operating instruction by marking either 'Single/Self', 'Either or Survivor', or 'Jointly'.

- List your Know Your Customer (KYC) documents that you are submitting, including photo ID and address proof. Provide the type of document and document number.

- Indicate the amount you are depositing as your first deposit, both in figures and words, and specify the mode of deposit.

- If you wish to nominate someone, provide the nominee’s name, address, date of birth, and share of the amount. If applicable, include a witness’s signature for this nomination.

- Provide your Aadhaar number if required.

- If applicable, fill out the guardian's name, their address, and the relationship to the minor for a minor account.

- For other situations, enter the name of the government welfare scheme along with any relevant registration or enrollment numbers.

- For a recurring deposit account, provide the amount of the monthly installment in both figures and words.

- If you are applying for a National Savings Certificate or Kisan Vikas Patra, indicate the number and denomination you wish to request.

- If you have sought the services of an agent, provide the agent's name and authority number.

- If you have any standing instructions, detail them here.

- Authorize the agent to receive passbooks or certificates on your behalf by providing their name.

- Carefully read the declarations and ensure you understand the rules and regulations related to the accounts or certificates. Sign and date the application form.

- After filling out all necessary fields, review the application for accuracy. Once completed, you have the option to save any changes, download, print, or share the form.

Complete your application online for a hassle-free experience.

Yes, it is safe to open a savings account in the Post Office. Post Office savings accounts are backed by the government, ensuring your funds are secure. Many people trust the Post Office due to its long history and commitment to customer service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.