Loading

Get Mscu Mnscu073 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MSCU MnSCU073 online

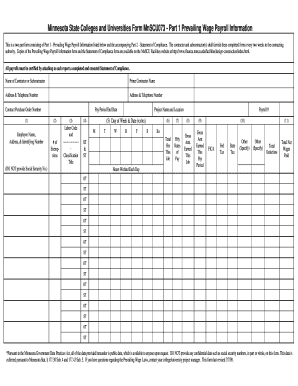

The MSCU MnSCU073 form is essential for reporting prevailing wage payroll information for contractors and subcontractors working in Minnesota. This guide will provide you with clear, step-by-step instructions on how to complete the form online effectively.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the MSCU MnSCU073 form and open it for editing.

- Begin by entering the name of the contractor or subcontractor in the designated field. Ensure that your information is accurate to avoid any processing delays.

- In the next section, input the prime contractor name along with their address and telephone number. Be diligent in providing correct contact information.

- Next, fill in the contract purchase order number in the appropriate field. This number ensures proper tracking of your contract.

- List each employee's name, address, and identifying number in the specified fields. Ensure that you do not include social security numbers, as it is prohibited.

- Indicate the pay period end date. This will help align your payroll reporting with the required submission schedule.

- Complete the section for exemptions by providing the number of exemptions relevant to each employee, if applicable.

- Fill in the labor code and classification title for each worker. This categorization is crucial for ensuring compliance with wage regulations.

- Write the project name and location where the work is being performed. This information helps identify the context of the payroll submissions.

- Document the hours worked each day for each employee in the corresponding fields. This should reflect the accurate hours logged throughout the week.

- Ensure to total the hours worked in the designated column for total hours per job and indicate any overtime (OT) or straight time (ST) hours.

- Complete the payroll information, including hourly rates of pay and gross amounts earned for the job and the current pay period.

- Fill in the deductions section, noting total deductions for federal tax, state tax, and any other applicable deductions. Specify if necessary.

- Finalize your form by reviewing all entries for accuracy. After confirming that all information is complete, proceed to save your changes.

Complete your MSCU MnSCU073 form online now to ensure timely and accurate payroll reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can obtain physical copies of tax forms at local libraries, post offices, and tax assistance centers. While these locations provide a selection, accessing a broader range of forms is often easier online. For forms such as MSCU MnSCU073, consider using the USLegalForms platform to get the copies you need quickly and efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.