Loading

Get Getting Paid Math Answer Key

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Getting Paid Math Answer Key online

Completing the Getting Paid Math Answer Key online is a crucial step in understanding personal finance and earning assessments. This guide will provide you with clear, step-by-step instructions to ensure you fill out the form accurately and efficiently.

Follow the steps to successfully fill out the form.

- Click ‘Get Form’ button to obtain the Getting Paid Math Answer Key and open it for editing.

- Begin by entering your name in the designated field to identify your work. Ensure accuracy as this may be used for grading or feedback.

- Fill in the total points possible for the assignment at the relevant section, using the criteria provided.

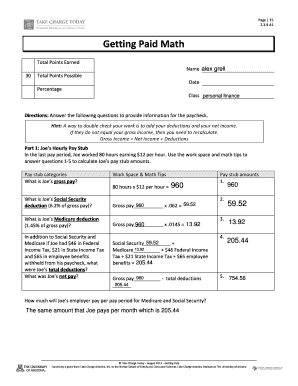

- For Part 1, use the provided information about Joe's hourly pay stub to answer questions 1-5. Utilize the work space for calculations, starting with Joe's gross pay.

- Proceed to calculate Joe's deductions for Social Security and Medicare using the formulas given. Ensure you show your calculations in the work space.

- Continue answering the remaining questions regarding Joe’s total deductions and net pay, making sure all figures are correctly calculated.

- In Part 2, follow similar steps for Edwin’s salary pay stub, starting with his monthly gross pay and calculating deducted amounts as instructed.

- Complete Edwin’s year-to-date amounts based on the answers calculated and transfer those figures into the provided sections of the form.

- For Part 3, assist with Zoe's pay stub calculations by filling in her earnings, deductions, and net pay based on the given example.

- Review all entries before finalizing, ensuring all calculations are correct and neatly entered into the form. Save your changes, and choose to download, print, or share the completed document as needed.

Take the next step towards mastering personal finance by completing your Getting Paid Math Answer Key online today!

Net pay is the take-home pay an employee receives after you withhold payroll deductions. You can find net pay by subtracting deductions from gross pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.