Loading

Get Hs304

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hs304 online

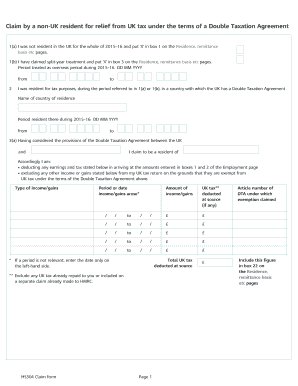

The Hs304 form is essential for individuals who are non-UK residents seeking relief from UK tax under a Double Taxation Agreement. This guide will provide comprehensive instructions to help you accurately complete the form online with confidence.

Follow the steps to successfully complete the Hs304 online.

- Click ‘Get Form’ button to obtain the Hs304 form and open it in the digital form editor.

- Begin by providing your residency information for the relevant tax year, indicating whether you were not a UK resident for the entire period by marking 'X' in box 1 on the Residence, remittance basis etc pages.

- If applicable, indicate your eligibility for split-year treatment by marking 'X' in box 3 and specify the overseas period by entering the starting and ending dates.

- In the following section, identify your country of residence during the tax year and provide the period of your residency there.

- Next, state the relevant Double Taxation Agreement by specifying the UK and your country of residence and asserting your claim to be a resident of that country.

- Detail any income or gains that you are subtracting in calculating the amounts in boxes 1 and 2, along with any UK tax deducted at source.

- If you are claiming partial relief from UK tax, fill out the necessary sections for partial relief, stating the nature of income and the related amounts.

- Indicate whether you have previously submitted an application for relief at source and answer the questions regarding previous claims made to HMRC.

- Review your completed form for accuracy and ensure all sections are filled out as required, including the declaration of correctness.

Start filling out your Hs304 form online today for a smoother tax relief process.

Certificate of residence You will need to send this when you file your tax return. To get one, you should contact your country's tax authority. If you are claiming relief as a Dual Resident (using form HS302), the certificate of residence must show that you are a resident of that country under their domestic laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.