Loading

Get Suggested Exemption Certificate For Purchases Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the suggested exemption certificate for purchases of industrial machinery and equipment online

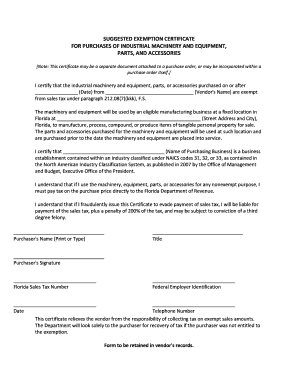

Filling out the suggested exemption certificate for purchases of industrial machinery and equipment is an essential step to ensure that your purchase is exempt from sales tax. This guide provides clear and supportive instructions to help you navigate each section of the form with confidence.

Follow the steps to complete your exemption certificate effectively.

- Click ‘Get Form’ button to obtain the certificate and open it in your preferred document editor.

- In the first section, enter the date of purchase in the field provided. This date marks when the exemption applies, so it is essential to input it accurately.

- Next, type the vendor's name in the designated space. This is the person or business from whom the machinery and equipment are being purchased.

- Fill in the street address and city where the machinery and equipment will be used. This must be within Florida and at a fixed location for eligible manufacturing purposes.

- Identify the name of the purchasing business in the specified area. Ensure that this business is classified under one of the relevant NAICS codes (31, 32, or 33) to maintain eligibility for the exemption.

- Acknowledge your understanding of the conditions of the exemption by reading the statement. This includes the requirement to pay sales tax if the machinery or parts are used for nonexempt purposes.

- Print or type your name in the purchaser’s name field. This should be the individual representative of the purchasing business.

- Indicate your title in the appropriate section, reflecting your position within the purchasing business.

- Sign the document in the purchaser's signature area, confirming that all provided information is accurate and truthful.

- Complete the final fields by entering your Florida sales tax number, federal employer identification number, the date, and your telephone number.

- Once all sections are filled out, save your changes, and choose to download, print, or share the completed exemption certificate as necessary.

Begin completing your exemption certificate online today to ensure your purchases are tax-exempt.

Individuals or businesses may qualify to make tax-exempt purchases. Our Amazon Tax Exemption Program (ATEP) supports tax-exempt purchases for sales sold by Amazon, its affiliates, and participating independent third-party sellers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.