Loading

Get Difficulty Of Care Exclusion Form - Pcg Public Partnerships

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Difficulty Of Care Exclusion Form - PCG Public Partnerships online

This guide serves as a comprehensive resource for users looking to complete the Difficulty Of Care Exclusion Form from PCG Public Partnerships. By following these steps, you can ensure that your form is filled out accurately and submitted correctly.

Follow the steps to complete the Difficulty Of Care Exclusion Form meticulously.

- Click the ‘Get Form’ button to access the Difficulty Of Care Exclusion Form. This will allow you to open and work on the form in an online document editor.

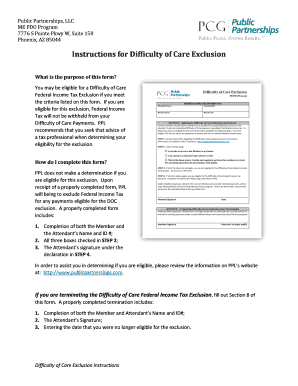

- Fill in the Attendant’s Name and Attendant ID in the designated fields at the top of the form. Next, input the Member’s Name and Member ID accurately to ensure proper identification.

- In Section A, read the information provided regarding the eligibility for the Difficulty Of Care Federal Income Tax Exclusion. This section will guide you on the criteria you need to meet.

- In STEP 2, check all three boxes that apply to your situation. These boxes confirm that you provide services to the Member in your home and specify your living arrangements.

- If you do not meet the criteria stated in STEP 2, you are not eligible for the exclusion. In this case, you do not need to submit the form.

- If you have checked all boxes in STEP 2, proceed to complete the remaining information section. After this, sign under the declaration in STEP 4 to validate your eligibility.

- Finally, review all filled-out sections for completeness. You can then save changes, download the form, print it, or share it as needed before submission to PCG Public Partnerships.

Get started today by filling out your Difficulty Of Care Exclusion Form online.

Difficulty of care payments are subject to FICA, FUTA, and SUTA unless the employee is already employment tax exempt due to a qualifying familial relationship to the employer. (Please see 'Understanding Fringe and Employment Tax Exemptions'.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.