Loading

Get In-kind Donation Verification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the In-Kind Donation Verification Form online

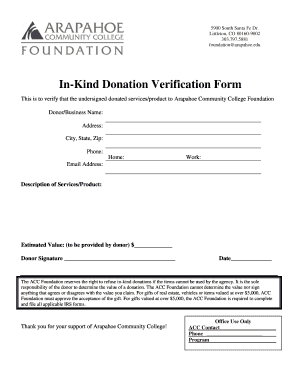

Filling out the In-Kind Donation Verification Form online is a straightforward process designed to facilitate the documentation of donations made to the Arapahoe Community College Foundation. This guide will walk you through each section of the form, ensuring that you provide all necessary information accurately.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the In-Kind Donation Verification Form and open it in your preferred online editor.

- In the first section, enter the donor or business name. This should reflect the individual or organization making the donation.

- Next, fill in the address fields. Include the street address, city, state, and zip code to ensure accurate contact information.

- Provide the phone numbers in the designated fields. You should include both home and work numbers for potential follow-up.

- Enter the email address of the donor. This will be used for any communication regarding the donation.

- In the description field, detail the services or products being donated. Be clear and concise to help the foundation understand what has been offered.

- Estimate the value of the donation in the provided space. This value should be determined by the donor and is crucial for documentation purposes.

- The donor must sign the form in the designated space to confirm their donation. This signature is necessary for validation.

- Finally, indicate the date when the donation is being made. This helps in tracking the timeframe of the donation.

- Once all fields are completed, you can choose to save any changes, download, print, or share the completed form as needed.

Start filling out the In-Kind Donation Verification Form online today to support Arapahoe Community College!

Forms 8283 and 8282 are required for documenting receipt of certain noncash contributions and subsequent dispositions of donated assets. Failure to file can cause the IRS to assess penalties and potentially disallow a charitable contribution deduction for the donor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.