Get Form W-8 Attachment X 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-8 Attachment X online

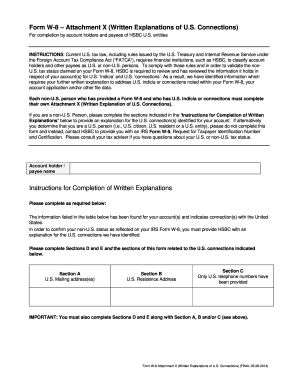

Filling out the Form W-8 Attachment X online can seem daunting, but this guide will walk you through each step in a clear and concise manner. This form is essential for non-U.S. persons to provide written explanations for their U.S. connections and maintain their non-U.S. tax status.

Follow the steps to complete the Form W-8 Attachment X online.

- Click 'Get Form' button to obtain the form and open it in the designated editor.

- Carefully read the instructions provided on the form to understand the requirements and sections that need to be completed.

- In Section A, provide an explanation for any U.S. mailing address found related to your account by selecting the appropriate box.

- In Section B, explain your U.S. residence address, selecting from the options provided to clarify your status.

- In Section C, address the U.S. telephone number(s) associated with your account by checking the relevant box and providing explanations.

- Complete Section D, the Substantial Presence Test, by answering the questions about your presence in the U.S. and filling out the days present table as instructed.

- Finally, sign and date Section E, declaring your non-U.S. status and providing any required documentation to support your claims.

- Once completed, save your changes, download the form, or print it for your records, and ensure to share it with the necessary entities.

Start completing your Form W-8 Attachment X online today to ensure compliance with U.S. tax regulations.

Related links form

The W-8BEN form, specifically designed for individuals, allows non-residents to certify their foreign status to U.S. withholding agents. Using the Form W-8 Attachment X helps individuals claim reduced withholding rates on U.S. income, such as dividends and royalties. It is a vital tool for preserving more of your earnings while ensuring compliance with tax laws. Completing this form accurately can prevent excess tax withholding.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.