Loading

Get Form 8951 (rev. September 2015). Compliance Fee For Application For Voluntary Correction Program

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8951 (Rev. September 2015). Compliance Fee For Application For Voluntary Correction Program online

Filling out Form 8951 is an important step in the Voluntary Correction Program for retirement plans. This guide will provide you with clear instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the form with ease.

- Click the 'Get Form' button to obtain the form and open it in your chosen editor.

- Begin by entering the name of the plan sponsor in the first field. This should reflect the employer's name if it is a single-employer plan.

- Next, fill in the plan sponsor's employer identification number (EIN) in the second field. Ensure this is correct as it will link your submission to the correct entity.

- In the third field, enter the plan number. This is a unique identifier for the plan and is crucial for tracking purposes.

- The fourth field requires the name of the plan. This should match the title used in other official documents.

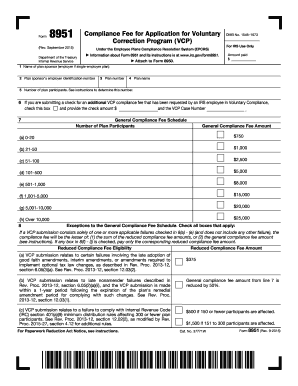

- For the fifth field, input the number of plan participants. Consult the instructions if you are unsure how to determine this number.

- If applicable, check the box in the sixth field if you are submitting a check for an additional compliance fee that has been requested by an IRS employee.

- Complete line seven by selecting the appropriate compliance fee based on the number of plan participants from the provided schedule.

- In line eight, check any boxes that apply regarding exceptions to the general fee schedule, if relevant. Review the specific criteria for each eligibility category.

- Finally, review all entries for accuracy, ensuring all sections are complete before saving your changes, downloading, printing, or sharing the form as needed.

Complete your documents online to ensure compliance and avoid penalties.

A Voluntary Correction Program (VCP) submission is a way for an employer or plan representative to voluntarily disclose issues with the retirement plan. These usually come in the form of an IRS compliance statement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.