Loading

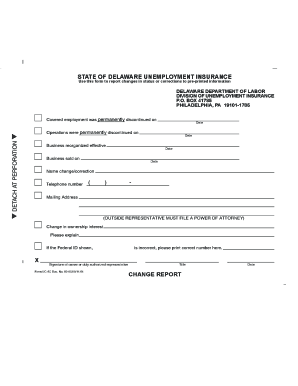

Get De Employer's Quarterly Report - Forms Set

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE Employer's Quarterly Report - Forms Set online

The DE Employer's Quarterly Report - Forms Set is essential for employers in Delaware to report wages and taxes for their employees. This guide provides clear instructions to help you successfully complete the necessary forms online.

Follow the steps to complete the DE Employer's Quarterly Report - Forms Set online

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Fill out the Quarterly Tax Report (UC-8). Start by indicating the reporting period and due date at the top of the form. Ensure you complete all fields to avoid processing delays.

- In lines 1 to 10 of UC-8, enter the following details: the number of covered workers, gross covered wages from UC-8A, excess wages, taxable wages, and calculate your tax due based on the taxable wage amount.

- Record any approved credits in line 6. Subtract this from your tax due to determine your net tax due on line 7.

- If applicable, calculate interest and penalty charges for late reporting and enter these on lines 8 and 9 respectively.

- Total lines 7, 8, and 9 to arrive at your payment due amount on line 10.

- Complete the Quarterly Payroll Report (UC-8A) to report gross covered wages for all employees. Ensure to include each employee's Social Security number and total wages.

- If you have more employees than can fit on the form, use continuation pages. Ensure all pages include necessary details like employer name and employee wages.

- After completing all sections, review for accuracy and confirm all necessary signatures are included. The report must be signed by the employer or a duly authorized representative.

- Finally, save your changes, download the form, and share or print it as needed for submission.

Get started on completing your DE Employer's Quarterly Report - Forms Set online today!

Delaware. 2023 SUTA rates range from 0.30% to 8.20% for employers in Delaware. The taxable wage base decreased to $10,500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.