Loading

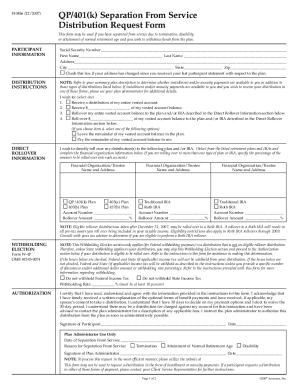

Get Qp/401(k) Separation From Service Distribution Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the QP/401(k) Separation From Service Distribution Request Form online

Completing the QP/401(k) Separation From Service Distribution Request Form online is a straightforward process that allows you to withdraw your funds after separating from service due to termination, disability, or reaching normal retirement age. This guide provides step-by-step instructions to assist you in accurately filling out the form.

Follow the steps to successfully submit your distribution request

- Click ‘Get Form’ to access the QP/401(k) Separation From Service Distribution Request Form. This will open the form for editing.

- Enter your social security number, first name, last name, and address in the participant information section. Don't forget to check the box if your address has changed since your last statement.

- In the distribution instructions section, select how you wish to receive your funds by checking one of the provided options: receive the entire balance, a specific dollar amount, or roll over the funds to another account. If rolling over a partial amount, specify the exact dollar amount.

- Complete the insurance information section if your retirement account includes life insurance. Specify whether you wish to surrender the policy or assign it to yourself, and provide beneficiary information if applicable.

- Fill out the direct rollover information section, specifying the financial organization and the account type for the rollover, along with the relevant account numbers. Indicate the rollover amounts for each account if applicable.

- Complete the withholding election section if your distribution is not an eligible rollover. Specify any preferences for federal and state income tax withholding as necessary.

- Authorize the request by signing and dating the form in the authorization section. Ensure all information is accurate before submission.

- After completing the form, save your changes. You can now download, print, or share the completed form as needed.

Start filling out your QP/401(k) Separation From Service Distribution Request Form online today!

Related links form

Form 1099-R: The payer enters Code 2 in box 7 if your are under age 59 1/2 and the payer knows that you qualify for an exception. Form 1099-R is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, Insurance contracts, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.