Loading

Get Mileage Form Guidelines - Rabbit Transit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mileage Form Guidelines - Rabbit Transit online

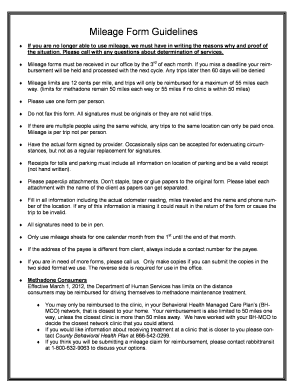

Filling out the Mileage Form Guidelines for Rabbit Transit is essential for users seeking reimbursement for transportation related to medical appointments. This guide will walk you through the necessary steps to successfully complete the form online, ensuring you have all the required information for a smooth submission process.

Follow the steps to accurately complete the Mileage Form Guidelines

- To obtain the form, locate and click the ‘Get Form’ button to access the Mileage Form Guidelines in your preferred editor.

- Complete the form with all required details including the date, time, medical location, and address.

- Ensure you input the actual odometer reading and the total miles traveled for each trip.

- Have the form signed by the provider in pen; remember that signatures must be original and no substitutes are allowed.

- Attach any necessary receipts for tolls and parking, ensuring they include all relevant information and are valid.

- Make sure to use one form per person and label any attachments with the person's name to avoid separation.

- Double-check that all information is accurate and complete, as any missing details may result in processing delays.

- Submit the completed form by the 3rd of each month to ensure timely processing; late submissions will be rolled into the next cycle.

- Once reviewed, you can save your changes, download a copy for your records, print the form, or share it as needed.

Start filling out the Mileage Form Guidelines online today for your reimbursement claims!

If you're keeping a mileage log for IRS purposes, your log must be able to prove the amount of miles driven for each business-related trip, the date and time each trip took place, the destination for each trip, and the business-related purpose for traveling to this destination.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.