Loading

Get Form 14653

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 14653 online

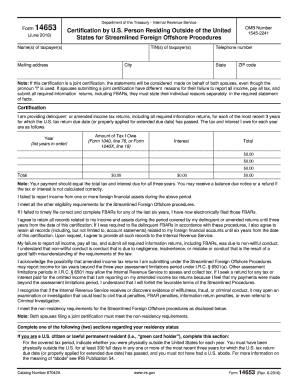

Filling out Form 14653 is an essential task for U.S. persons residing outside the United States seeking to certify for streamlined foreign offshore procedures. This guide provides clear, step-by-step instructions to help you complete the form effectively online.

Follow the steps to fill out Form 14653 online:

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Enter the name(s) of the taxpayer(s) in the designated field.

- Fill in the Taxpayer Identification Number (TIN) in the relevant field.

- Provide your mailing address, including city, state, and ZIP code.

- Indicate your telephone number for contact purposes.

- If submitting a joint certification, include the information for both spouses as needed.

- In the certification section, affirm that you are submitting delinquent or amended tax returns for the past three years.

- List the years for which you are submitting tax returns and input the total tax, interest owed, and overall total due for each year.

- Check the boxes to indicate any failure to report income and confirm eligibility for the Streamlined Foreign Offshore procedures.

- Complete the residency status section based on whether you are a U.S. citizen or lawful permanent resident.

- Detail your physical presence outside of the United States for the required time frame.

- Provide a comprehensive personal narrative detailing the reasons for your failure to report all income and submit required returns.

- Sign and date the certification, ensuring all required signatures are included for joint submissions.

- After completing the form, review all entries for accuracy.

- Save your changes, then download, print, or share the completed form as needed.

Complete your Form 14653 online today and ensure you comply with the requirements for streamlined foreign offshore procedures.

Streamlined Foreign Offshore Procedures: The IRS Streamlined Foreign Offshore Procedures (SFOP) are a program designed to bring certain individuals with undisclosed foreign income, investments, assets or accounts into IRS Offshore Compliance without issuing any penalties against the taxpayer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.