Loading

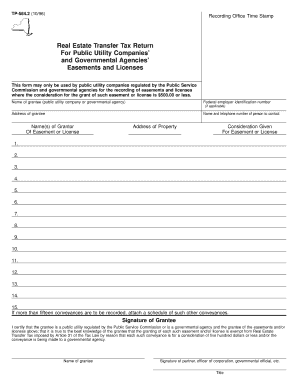

Get Form Tp-584.2:10/96:real Estate Transfer Tax Return For ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form TP-584.2:10/96: Real Estate Transfer Tax Return for public utility companies and governmental agencies online

Filling out the Form TP-584.2:10/96 is essential for public utility companies and governmental agencies when recording easements and licenses. This guide provides user-friendly, step-by-step instructions to help you navigate the online filling process efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the form and load it in your preferred online editor.

- Enter the name of the grantee, which is typically the public utility company or governmental agency that is receiving the easement or license.

- If applicable, provide the federal employer identification number for the grantee.

- Fill in the address of the grantee to ensure accurate identification and communication.

- Input the name and telephone number of a contact person associated with the grantee, which will assist in any needed correspondence.

- List the name(s) of the grantor(s) of the easement or license in the designated field.

- If there are more than fifteen conveyances to record, attach a schedule detailing these additional conveyances.

- The grantee must sign the form to certify that the information provided is correct and that the transaction is exempt from the Real Estate Transfer Tax.

- Include the printed name of the grantee, which could be a partner, officer of a corporation, or governmental official.

- Add the title of the signee to clarify their capacity in relation to the grantee organization.

- Review all entries for accuracy before finalizing the form.

- Save your changes to the form once you have completed all fields.

- Download the completed form, print it, or share it as required.

Complete your Form TP-584.2:10/96 online today to streamline your real estate transaction process.

The combined NYC and NYS Transfer Tax for sellers is between 1.4% and 2.075% depending on the sale price. Sellers pay a combined NYC & NYS Transfer Tax rate of 2.075% for sale prices of $3 million or more, 1.825% for sale prices above $500k and below $3 million, and 1.4% for sale prices of $500k or less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.