Loading

Get Uc 018 Ff

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uc 018 Ff online

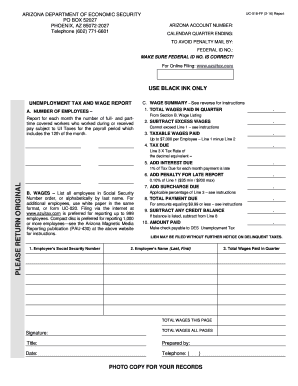

The Uc 018 Ff form is essential for reporting unemployment tax and wage data to the Arizona Department of Economic Security. In this guide, you will find step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the Uc 018 Ff online

- Click ‘Get Form’ button to access the Uc 018 Ff and open it in your preferred editor.

- Fill in the Arizona account number at the top of the form. Ensure that this is accurate to avoid processing delays.

- Enter the calendar quarter ending date. This will indicate the period for which you are reporting wages and taxes.

- To avoid penalties, ensure to mail the form by the specified date provided.

- Input your federal ID number. Double-check to ensure it is correct, as errors can cause complications.

- Report the number of employees who worked during the payroll period that includes the 12th of the month.

- Complete Section A with total wages paid in the quarter from Section B wage listing.

- Subtract any excess wages that exceed the limits outlined in the instructions.

- Calculate taxable wages paid, which should not exceed $7,000 per employee.

- Determine the tax due by multiplying the taxable wages by the applicable tax rate.

- If necessary, add any interest due for late payments, calculated at 1% per month.

- Include any late report penalty, which is 0.10% of Line 1, with minimum and maximum amounts indicated.

- List all employees in order by their social security numbers or alphabetically by last name in Section B.

- If you have more employees than the form allows, continue on white paper or the UC-020 form.

- Add any surcharge due as applicable to your report according to the instructions.

- Calculate the total payment due based on the previous information.

- Subtract any credit balance if applicable from the total payment due.

- Complete the section for amount paid and include payment information as required.

- Remember to sign and date the form, including your title and telephone number if necessary.

- Once your form is fully completed, save your changes, and proceed to download, print, or share it as needed.

Take action now to complete your Uc 018 Ff online and ensure compliance with Arizona tax regulations.

Businesses determined liable to provide unemployment insurance coverage for their workers are required to. submit Unemployment Tax and Wage Reports (UC-018) for each quarter they are covered, even for quarters during which no wages were paid, and. to pay taxes each quarter taxable wages were paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.