Loading

Get Form 49b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 49b online

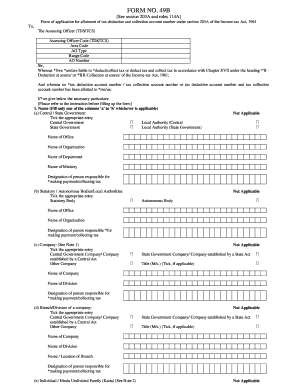

Filling out the Form 49b online is a straightforward process that allows you to apply for the allotment of a tax deduction and collection account number. This guide will assist you in completing each section of the form accurately to ensure compliance with the Income-tax Act, 1961.

Follow the steps to complete the Form 49b online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, select the appropriate category that applies to you by ticking the relevant box. This may include options such as Central or State Government, Statutory Bodies, Companies, or Individuals. Ensure you provide the name of the office or organization if applicable.

- Proceed to fill out your address in Section 2. Include all relevant details such as street, city, state, and pin code. Provide a telephone number that includes the STD code.

- In Section 3, indicate your nationality by ticking either 'Indian' or 'Foreign'.

- Enter your Permanent Account Number (PAN) in Section 4 and any existing Tax Deduction Account Number (TAN) and Tax Collection Account Number (TCN) in Sections 5 and 6, respectively. If you do not have a TAN or TCN, you may leave these sections blank.

- Fill in the date in the format DD-MM-YYYY in Section 7. This is the date you are submitting the form.

- At the end of the form, you will need to verify the information provided. Sign the form or provide a left thumb impression as required, confirming that the information is true to the best of your knowledge.

- Once all sections of the form are completed, you can save the changes, download the document for your records, or print it out. You may also choose to share the form digitally if required.

Complete your Form 49b online today to ensure compliance with tax regulations.

Form 49B is an application for the allotment of TAN number or collection and deduction account number under section 203A of the Income Tax Act, 1961. Registration of TAN is necessary for all people who need to deduct TDS on their transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.