Loading

Get Nz Ir330 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ IR330 online

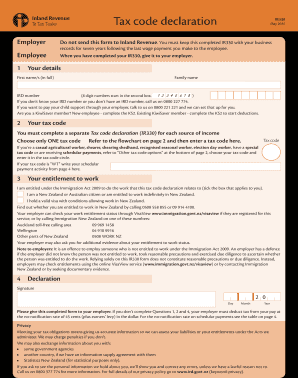

The NZ IR330 form is essential for providing your tax code declaration to your employer. This guide offers clear, step-by-step instructions on how to fill out the form accurately and submit it online to ensure compliance with tax regulations in New Zealand.

Follow the steps to complete your NZ IR330 online efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your full first name(s) and family name in the designated fields.

- Input your IRD number in the correct format (8-digit number starting in the second box). If you do not know your IRD number, you can call 0800 227 774 for assistance.

- Indicate whether you are a KiwiSaver member. If you are a new employee, complete the KS2 form. If you are an existing KiwiSaver member, also complete the KS2 form to start deductions.

- Select one tax code that applies to you. Refer to the flowchart provided in the form to determine the correct code.

- Tick the box that confirms your entitlement to work in New Zealand per the Immigration Act 2009.

- Sign and date the declaration at the bottom of the form. Ensure to provide the current date in the format specified.

- Once you have completed your IR330, give it to your employer. Do not send this form to Inland Revenue; keep it with your business records for seven years.

Complete your NZ IR330 online today to ensure your tax code declaration is processed correctly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

New Zealand does not generally tax US social security benefits, making them an exception in the tax system. However, this can depend on individual circumstances, such as residency status. It’s wise to consult tax guidelines or a professional when determining how this might affect your tax filings with forms like the NZ IR330.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.