Loading

Get Uk Hmrc Starter Checklist 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC Starter Checklist online

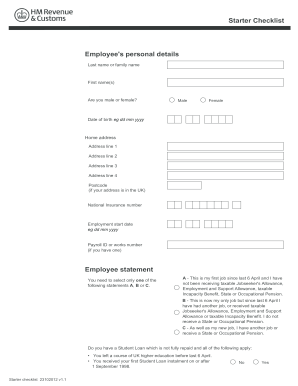

The UK HMRC Starter Checklist is an essential document for new employees to provide their personal details and tax information. This guide will walk you through the process of filling out the form online, ensuring that you complete each section accurately and efficiently.

Follow the steps to successfully complete the Starter Checklist.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your last name or family name in the designated field. Then, input your first name(s).

- Indicate your gender by selecting either 'male' or 'female.' This is important for personal identification purposes.

- Provide your date of birth in the specified field to verify your age and eligibility.

- Fill in your home address details. This includes address line 1, address line 2, address line 3, address line 4, and your postcode if you reside in the UK.

- If you have one, enter your National Insurance number in the appropriate field.

- Specify your employment start date, which is necessary for your tax record.

- If applicable, include your payroll ID or works number in the designated section.

- Read through the employee statement options carefully and select only one of the following statements A, B, or C, based on your employment situation.

- Lastly, if you have a Student Loan that is not fully repaid, indicate yes or no, and ensure all conditions are met.

- After completing all fields, review your information for accuracy. You can now save changes, download, print, or share the form as needed.

Complete your UK HMRC Starter Checklist online today to ensure a smooth start to your employment!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

New employees are required to share several key pieces of information. This typically includes personal details, tax code, and bank account information for payroll. Collecting this information helps streamline the employment process and ensures compliance. The UK HMRC Starter Checklist provides a thorough overview of what you need.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.