Loading

Get Trcn1 Tax Registration Cancellation Notification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TRCN1 Tax Registration Cancellation Notification Form online

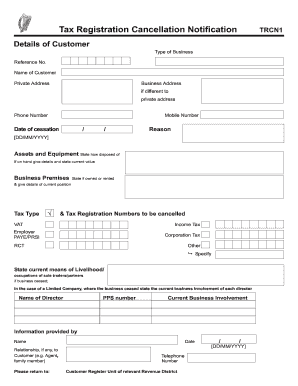

The TRCN1 Tax Registration Cancellation Notification Form is essential for notifying the relevant tax authority about the cancellation of a tax registration. This guide provides comprehensive step-by-step instructions on how to complete this form online, ensuring a smooth process for users with various levels of experience.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the 'Details of Customer' section. This includes providing the type of business, reference number, name of customer, and both private and business addresses, if applicable.

- Enter the contact information, including phone number and mobile number, ensuring that these are current and correct.

- Specify the date of cessation of business in the format DD/MM/YYYY.

- Provide a detailed explanation for the reason for cancellation. Be clear and concise.

- State how assets and equipment have been disposed of. If any are on hand, provide details and their current value.

- Indicate the status of the business premises, stating whether it is owned or rented, along with details of the current situation.

- Tick off the applicable tax types to be cancelled and enter the corresponding tax registration numbers.

- Detail the current means of livelihood or occupations for sole traders or partners, particularly if the business has ceased.

- For limited companies, provide the current business involvement of each director, including their names, PPS numbers, and respective involvements.

- Fill in the section for information provided by including your name and relationship to the customer, if any.

- Finally, return to the form completion date, ensuring to use the format DD/MM/YYYY, and provide a contact telephone number for any follow-up.

- Review all entered information for accuracy before saving changes, downloading, printing, or sharing the completed form.

Complete your TRCN1 Tax Registration Cancellation Notification Form online today to ensure a timely cancellation of your tax registration.

Related links form

Each system unit and local lodge unit must file an annual tax return, Form CT-1, Employer's Annual Railroad Retirement Tax Return, with the Internal Revenue Service (IRS).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.