Loading

Get It03 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It03 Form online

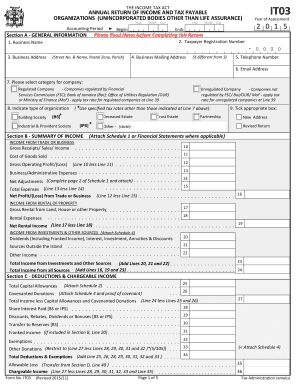

The It03 Form is essential for reporting income and tax liabilities for certain organizations. This guide provides clear and supportive step-by-step instructions to help users complete the form correctly and efficiently online.

Follow the steps to successfully fill out the It03 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- In Section A - General Information, enter the business name, taxpayer registration number, business address, and contact information. Ensure all fields are accurate to avoid delays.

- Select the type of organization in Box 8 and check the appropriate category in Line 7 to indicate whether the business is regulated or unregulated.

- Proceed to Section B - Summary of Income. Enter the gross receipts or sales and any cost of goods sold. Calculate the gross operating profit or loss.

- Document all business or administrative expenses in the respective line. Be precise and use verified amounts to reflect actual expenses.

- In Section C - Deductions & Chargeable Income, include total capital allowances and any covenanted donations. Attach necessary schedules as prompted.

- Complete Section E - Tax Computation if applicable; this section is not required for partnerships. Determine the applicable tax rates based on organizational type.

- If there are losses available carry forward, input those in Section D to calculate any offsets against taxable income.

- Review all the entered information for accuracy before submitting, making sure to attach any required documents as specified throughout the form.

- Finally, save your changes, and download or print the form for your records. If needed, you can also share it directly from the online editor.

Complete your It03 Form online today to ensure accurate reporting and compliance.

Additionally, taxpayers can use the ITR Form 3 if their total income includes the following: Income from a single-house property or multiple-house property. Income from activities like lotteries, betting on races, and other legal forms of gambling as per Indian law. Income from short-term or long-term capital gains.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.