Loading

Get Form 735 9002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 735 9002 online

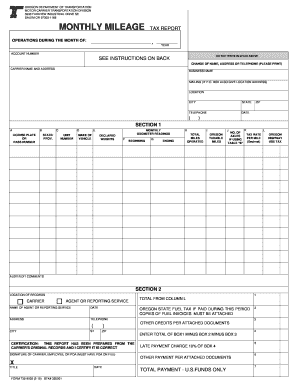

Filling out the Form 735 9002 online can simplify your reporting tasks and help ensure compliance with Oregon's tax laws. This guide provides a clear, step-by-step approach to successfully completing the form.

Follow the steps to effectively complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the month and year for which you are reporting in the specified fields. Ensure accuracy as this sets the context for the entire report.

- Input your account number in the designated field. This number is crucial for identifying your record with the Oregon Department of Transportation.

- Fill out the carrier name and address section accurately. Include your business name, mailing address, city, state, and telephone number. If you use a P.O. Box, also provide the physical location address.

- In Section 1, begin entering vehicle-specific data. For Column A, input the license plate or pass number of the power unit. Continue through the section, completing all relevant fields including state/province (Column B), unit number (Column C), vehicle make (Column D), and declared weights (Column E).

- Record your odometer readings: Column F for beginning mileage, Column G for ending mileage. Compute total miles operated in Column H (ending odometer minus beginning odometer) and enter Oregon taxable miles in Column I.

- Provide the number of axles in Column J if applicable, followed by the tax rate per mile in Column K and compute the total highway use tax in Column L by multiplying Oregon taxable miles by the tax rate.

- In Section 2, enter the location of records and details about your agent or reporting service if applicable. Fill out all required fields and ensure information is accurate.

- Calculate total fees by summing the relevant boxes. Include any late payment charges in Box 5 if the report is filed late.

- Review all filled sections carefully for accuracy. Save your changes, then choose to download, print, or share the completed form as necessary.

Complete your Form 735 9002 online today for streamlined processing and compliance.

File Weight-Mile Tax Reports Quarterly Complete the Application to File Quarterly Weight-Mile Tax Reports (form 9030). Return this form to us by December 31, 2022. Submit completed forms to CCD Tax Help by email or fax 503-378-3736.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.