Loading

Get Winner Claim Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Winner Claim Form online

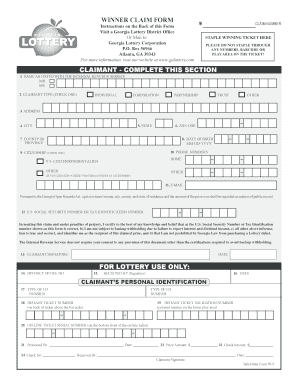

Completing the Winner Claim Form is a crucial step in claiming your prize. This guide will navigate you through each section of the form, ensuring you provide all the necessary information accurately and efficiently.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to access the Winner Claim Form and open it in your preferred editing tool.

- In the first section, enter your name as it appears on your tax records. It is important to be precise here to avoid any processing delays.

- Choose your claimant type by checking the appropriate box. This could be individual, corporation, partnership, trust, or other.

- Provide your complete address, including city, state, and zip code. Ensure each field is filled clearly.

- Fill in your county or province, and then enter your date of birth in the specified format (MM-DD-YYYY).

- List your phone numbers where you can be reached easily.

- Indicate your citizenship status by checking the relevant box. If you select 'Other', be prepared to specify your country of citizenship.

- Provide your email address for any correspondence related to your claim.

- Input your U.S. Social Security Number or Tax Identification Number. Ensure this number is correct to avoid issues.

- Sign the form to certify the information provided is correct and complete. Include the date next to your signature.

- Attach any required identification and documentation, such as your winning ticket and two forms of ID if claiming more than $600.

- Once all fields are filled out, review your information for accuracy. Save the changes, and if necessary, download, print, or share the completed form for your records.

Complete your Winner Claim Form online today for a smooth claiming experience.

Take your winning ticket to a Lottery retailer and the clerk will hand you cash on the spot....For in-person window service: Follow the steps above for completing your claim form. Groups claiming prizes may send a single representative but the representative will need to bring completed forms for all group members.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.